UAE Offers Corporate Tax Fine Waiver: Relief Measures

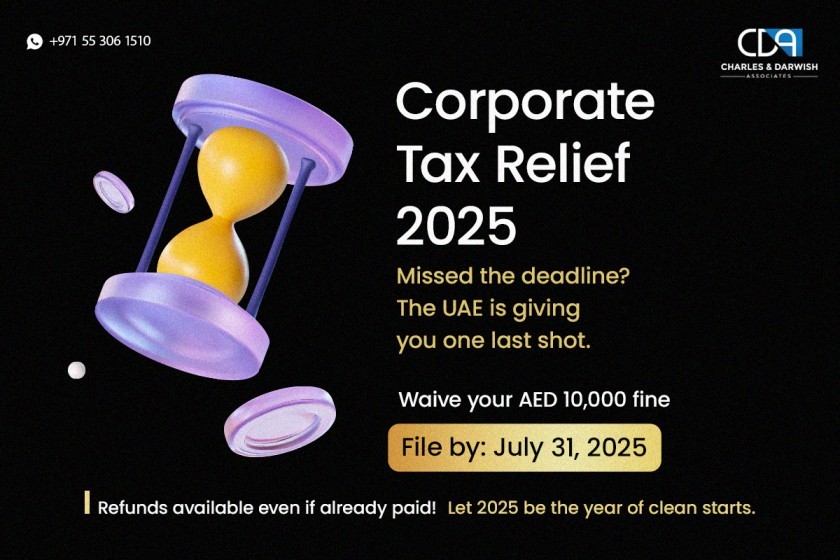

Has your company received a penalty of AED 10000 for late or incomplete corporate tax registration?

The Federal Tax Authority (FTA), under the oversight of the UAE Government and the Ministry of Finance, has launched an initiative to waive or recover the administrative penalties. The initiative targets companies and certain exempt entities that failed to comply with corporate tax registration requirements.

The authorities issued a detailed public clarification in July 2025, which specified the eligibility criteria, timelines, and procedures for availing of the penalty waiver; this clarification followed the initial announcement made on the 2nd of May 2025. Eligible businesses must complete all required actions by 31 July 2025 in order to benefit from the penalty waiver.

Who all Qualifies for the Waiver?

As per the FTA, the corporate tax fine waiver is applicable for any taxable business or exempt entity, regardless of company size, provided that all other eligibility requirements are met:

- Taxable persons: If you missed the registration deadline but submitted your first corporate tax return within 7 months of the end of your first tax period, you qualify for the waiver.

- Exempt persons: If you received exemption approval and submit your annual declaration within 7 months from the end of your first tax period, you're eligible for the waiver.

- Tax group members: If the group’s initial return is filed within 7 months of the tax period's end, the group can also benefit from the penalty waiver.

The waiver also applies even if the business or entity has already paid the AED 10000 administrative penalty. In such scenarios, the amount will be refunded to the taxpayer’s EmaraTax account. It is important to note that the waiver is applicable only for the first tax period.

What You Must Do to Qualify

To ensure you remain eligible for the waiver, businesses must:

- Accurately file the UAE Corporate Tax return within the allotted timeline.

- Submit the necessary supporting records within 7 months from the end of the tax period.

- Maintain proper financial records that meet the International Financial Reporting Standards (IFRS).

- Remain audit-ready by keeping your documentation up to date.

Business Case Scenarios

Understanding how the FTA’s Corporate Tax waiver works can be easier when seen in real-world situations. Let us take a look at some practical situations where different fictional businesses approached the waiver process:

Scenario 1: Penalty Waived for On-time Return Submission

A business was issued the administrative penalty of AED 10000 as they failed to register for corporate tax before the FTA’s deadline. However, they acted fast and submitted their first corporate tax return within the 7-month window at the end of their tax period. As they filed their return on time, with all the proper details, they had their penalty waived under the new initiative.

Scenario 2: Penalty Refunded After Timely Filing

A company initially missed its corporate tax registration deadline and chose to pay the AED 10000 fine immediately to avoid legal consequences. They later filed the first tax return within the 7-month period. After meeting the eligibility criteria, the company applied for a refund through the EmaraTax platform. The FTA approved their pending request and credited the penalty amount back to their EmaraTax account.

Scenario 3: Missed Deadline, No Waiver Granted

A company missed both the corporate tax registration and filing its first tax return. The return was finally submitted, but outside the 7-month timeframe allotted for the waiver scheme. This resulted in the company bearing the full AED 10000 penalty without an opportunity for refund or reconsideration.

Scenario 4: Timely Tax Group Filing Secured Waiver for All Constituents

In the case of a corporate group, some companies failed to complete their corporate tax registration, resulting in penalties. However, the group filed its combined tax return within the 7-month period. This timely filing made all the constituents of the group eligible for the penalty waiver.

Scenario 5: Reconsideration Not Needed When Filing on Time

A company received a penalty notice for AED 10000 even after filing its corporate tax return within the 7-month grace period. They immediately filed a reconsideration request, and upon reviewing their filing, the FTA concluded that they had met the waiver conditions. The penalty was, hence, automatically cancelled under the waiver initiative and required no further action on the reconsideration.

Overview of the UAE Corporate Tax System

| Law Issue Date | 9 December 2022 |

| Law Effective Date | 25 October 2022 |

| Taxable Periods Covered | Financial years starting on or after 1 June 2023 |

| Penalty Effective Date | 1 August 2023 |

| Penalty Amount for Late Registration | AED 10,000 for each incident of late/incomplete registration |

| Waiver Initiative Announcement | 2 May 2025 |

| Penalty Waiver Effective | 14 April 2025 (for violations since 1 June 2023) |

| Waiver Clarification | July 2025 |

| Last Date for Waiver Eligibility | 31 July 2025 |

Final Reminder: Don’t Miss the Corporate Tax Waiver

If you haven’t registered for Corporate Tax, do it right away! Refer to the tax period and use the 7-month rule to file your returns through the EmaraTax platform. The AED 10000 penalty was set by the FTA to filter out non-compliance and enforce better implementation of the Corporate Tax framework.

With the current waiver initiative, eligible businesses and exempt entities have a limited window to avoid this penalty by registering promptly.

Take advantage of this one-time relief before the 31 July 2025 deadline and stay ahead with full compliance.

FAQs on Corporate Tax Waiver

What is the UAE corporate tax penalty?

The UAE corporate tax penalty comprises a fine of AED 10000 imposed on businesses and exempt entities that failed to register for corporate tax within the specified time.

How does the corporate tax penalty waiver work?

You can avoid paying the AED 10,000 fine by filing your return within 7 months after the end of your first tax period.

Is the waiver available for future tax periods?

No, it’s only a one-time relief for the first tax period.

Is it possible to get a refund if I already paid the corporate tax penalty?

Yes, if you meet the waiver conditions, you can apply for a refund through the EmaraTax platform.

What happens if I miss the deadline for the tax waiver?

If you miss the deadline, then you have to pay the administrative fine of AED 10000.

Mitesh Maithia

Tax Manager

Mitesh is a Tax Professional with expertise in direct, indirect, and international taxation, including transfer pricing, since 2018. Passionate about making complex tax matters simple, he shares insights to help businesses stay compliant and forward-looking.