How to Make Corporate Tax Payments using EmaraTax?

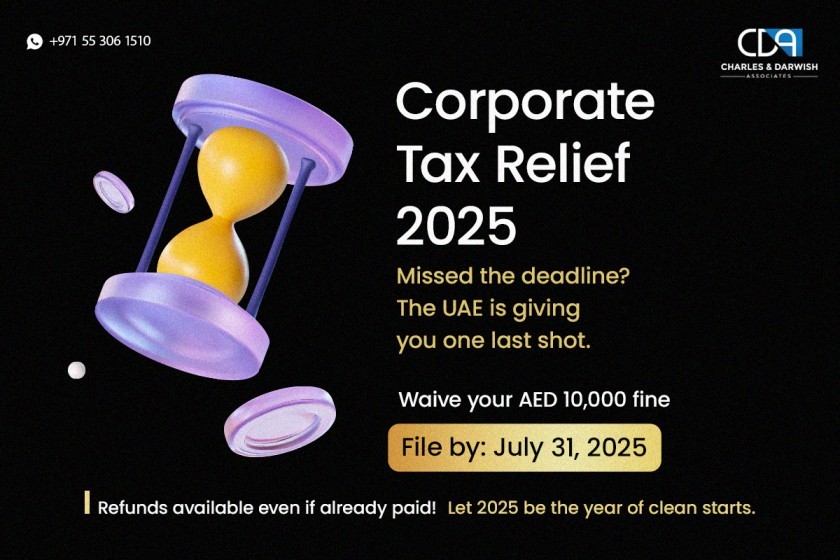

The UAE has been implementing all the possible options to enrich itself as the best tax-friendly landscape across the globe. Along with being stringent regarding the tax compliance, the UAE has adopted automation and technology in order to facilitate the taxpayers to file their returns and make the tax p...

Read More

628343e699421.jpg)

626a942c403c7.jpg)

62663043f32fa.jpg)

62617543b97ea.jpg)

61fce9bb2cd9a.jpg)

619ee80d28448.jpg)

609e8303c264a.png)

5e2e96240f59a.png)

5e2e99eab9e24.png)

5e2e9d46f2a02.png)

5e2e97216b404.png)

5e2e9c176c998.jpg)

5e2e9a323e217.png)

5e2e959831935.png)

5e2e9db0cc6bb.png)

5e2e9bcb4ec7a.jpg)

5e2e950c88a20.jpg)

5e2e97a6ec12a.png)

5e2e97fe908d6.png)

5e2e9cedccc7e.png)

5e2e9b35c0004.png)

5e2e9997e8f6d.jpg)

5e2e9eac6e810.jpg)

5e2e9f7c4ac3b.png)

5e2e987ce1591.jpg)

5e2e98cec9cfe.jpg)

5e2e94a1a1bea.jpg)

5e2e96740cc20.jpg)

5e2e94297ba7e.jpg)

5e2e9c92c960f.png)

5e2e9f2da6464.png)