Why a Small Business Should Outsource Accounting Services?

Being a business owner, you need to keep an eye fixed on everything. Being liable for your company’s success and ensuring everything happens as you've got envisioned may be a tough job that you simply had best. But there's one specific area that ought to be an equivalent for all companies, something that's only correct with no creative input - accounting. Today most companies outsource accounting for effective and efficient resource management. Still, there are more ways in which outsourcing may benefit a corporation big and small. In UAE more than 1/3 of small businesses are outsourcing their accounting. It's even tougher now to get an eligible person at a reasonable rate. Due to this fact, you would possibly consider outsourcing accounting services to the corporate with the proper knowledge and qualifications.

Typically, one or more of those triggers usually got to occur for a business owner to start finding a replacement accounting solution:

- Reaching AED 10 million in revenues

- Employing 8 to 10 people

- Accepting outside investor capital

- CEO cannot be involved in every aspect of the business

- Entering the faster growth stage of the business lifecycle

- Needing to urge more out of QuickBooks than billing and collections

- Wanting technology systems to interface and ask one another

We find business owners with a “getting better” agenda, who aren't proud of the staff, often value outsourcing accounting as to how to quickly move up to management accounting. It enhances the competitive advantage with none upfront investment of your money.

You can also read: Accounting Services – Taking Your Business To The Next Level

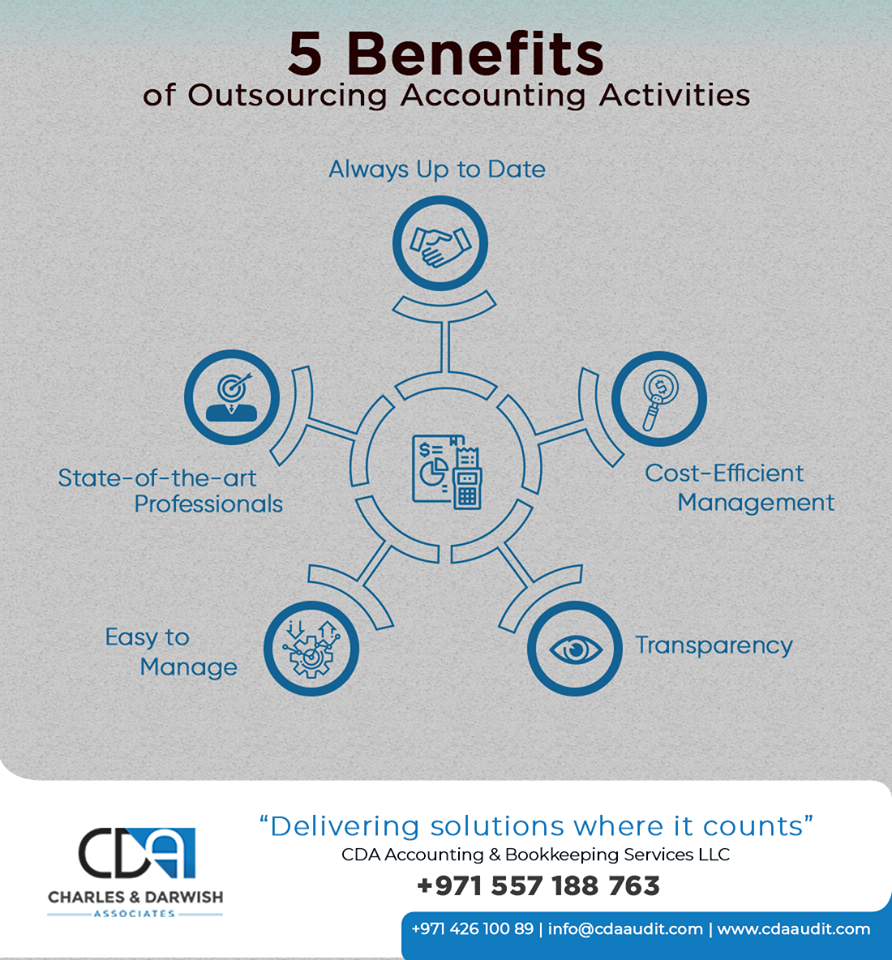

Benefits of Outsourcing Accounting

1. Cost Efficient

The best advantage of outsourcing accounting is the reduction in costs. Once you outsource your accounting, you're only paying for the accounting services you employ. Meaning, you simply buy the assistance once you need it. Outsource accounting eliminates standard employee expenses like benefits, insurance, payroll taxes, and paid leave. Once you prefer to outsource your accounting, you're reducing your overall operating expense.

2. Access to the Latest Technology

Accounting firms always want to form sure they're at the forefront of their industry. A neighbourhood of being at the forefront is to possess the newest technology. Once you have access to the newest accounting technology, it ensures your bookkeeping is usually up so far. Therefore, you recognize your cost better and may stay before the competition.

3. Regular Assessment

An outsourced firm allows you to stay track of your accounting records and data on a day to day basis. Most accounting firms assign a team to access your accounting records at need.

4. Expertise Knowledge

When you hire a firm, you'll rest easy knowing you've got access to the experts. Having a good expertise team on your side ensures the simplest financial reports that meet regulatory and compliance standards. Hire a third-party firm and rest assured that they're going to complete all of your accounting quickly and properly.

5. Better Time Use

When you outsource your accounting, you get time back that you simply won’t spend doing administrative tasks. The time you want to spend on accounting can now be wont to better your small business. Sometimes once you need to do tedious tasks like accounting, it's distracting to you. Hiring a firm, allows you to specialize in the core of your business. Doesn’t waste time worrying if your accounting is correct, outsource it instead.

You can also read: The Best Ways to Simplify and Optimize Your Small Business's Accounting System

CDA Accounting Outsourcing Services

CDA Accounting and Bookkeeping Services LLC offers a wide gamut of accounting services that meet the financial needs of any business in the international market. CDA safeguards that the financial statements are complying with the International Financial Reporting Standard (IFRS) and are steadfast to keep the uppermost level of professional canons and excellence.

Also read, How Outsourcing Accounting Services Helps Startups Or Entrepreneurs in Dubai?

CDA also offers various services, like CFO Services, Outsourced Accounting Services, Organizational Restructure, TAX or VAT Consulting Services, Implementation of Accounting Software Services, and Payroll Outsourcing Services to the business world. Running a small business and planning to outsource your accounting services? Get in touch with CDA, our experts help you with your business finance easily.

Mark Thompson

Full-stack Developer, Blogger, and Tech Enthusiast.

Mark specializes in digital marketing, SEO, and content strategy.